Irs real estate depreciation calculator

What is the depreciation rate for real estate. How to Calculate Depreciation in real estate.

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

GDS is the most.

. The first thing thats done when calculating the deprecation recapture is to determine the original purchase price. 6 days ago What is the depreciation rate for real estate. The MACRS Depreciation Calculator uses the following basic formula.

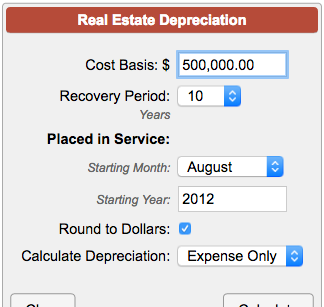

Ad We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds. Calculate the depreciation for a rental property or real estate using the straight line method and mid-month convention as required by the IRS for rental property and real property. This is the amount the business used for purchasing the property.

Three factors help determine the amount of Depreciation you must deduct each year. Build Your Future With a Firm that has 85 Years of Investment Experience. The recovery period varies as per the method of computing.

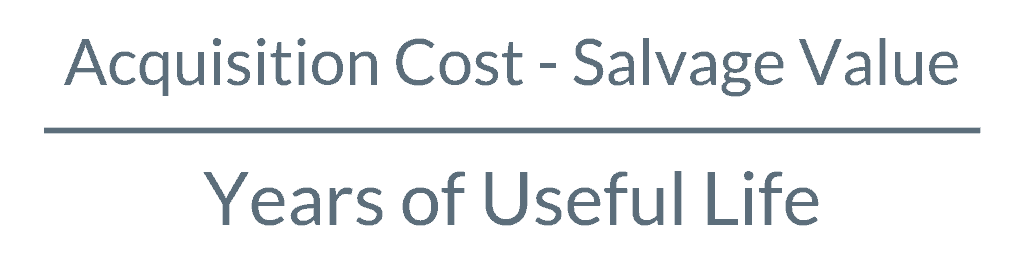

First one can choose the straight line method of. It provides a couple different methods of depreciation. Your basis in your property the recovery.

D i C R i. The recovery period varies as per the method of computing depreciation. The depreciation method used for rental property is MACRS.

This is the section 179. Where Di is the depreciation in year i. As a real estate investor.

Your depreciation deduction is 8000 calculated as 220000 divided by 275 years. You can elect to recover all or part of the cost of certain qualifying property up to a limit by deducting it in the year you place the property in service. According to the IRS the depreciation rate is 3636 each year.

Residential rental property owned for business or investment purposes can be depreciated over 275 years according to IRS Publication 527 Residential Rental. C is the original purchase price or basis of an asset. According to the IRS the depreciation rate is 3636 each year.

Even though you get to keep the entire 9600 because of depreciation you only pay. What is the best depreciation method for rental property. Depreciation recapture tax rates.

Per the IRS you are allowed an annual tax deduction for the wear and tear of property over the course of time known as Depreciation. There are two types of MACRS. Since depreciation recapture is taxed as ordinary income as opposed to capital gains your depreciation recapture tax rate is going to be your.

Tax provisions accelerate depreciation on qualifying business equipment office furniture technology software and other business items. Lets say that the original depreciable value of a rental property was 100000 and the investor owned the property for 30 years and all the depreciation 100000 has been used or taken. This depreciation calculator is for calculating the depreciation schedule of an asset.

For example if a new dishwasher was purchased for 600 had an estimated useful life of five years and would be worth 100 at resale at the end of the five years then the.

Depreciation Calculator For Home Office Internal Revenue Code Simplified

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

Rental Property Depreciation Calculator Cheap Sale 60 Off Www Barribarcelona Com

Guide To The Macrs Depreciation Method Chamber Of Commerce

Rental Property Depreciation Calculator Flash Sales 53 Off Www Ingeniovirtual Com

Straight Line Depreciation Calculator And Definition Retipster

Macrs Depreciation Calculator Irs Publication 946

Residential Rental Property Depreciation Calculation Depreciation Guru

How To Calculate Depreciation On Rental Property

Rental Property Depreciation Calculator Discount 59 Off Www Ingeniovirtual Com

Residential Rental Property Depreciation Calculation Depreciation Guru

Macrs Depreciation Calculator With Formula Nerd Counter

Free Macrs Depreciation Calculator For Excel

Straight Line Depreciation Calculator And Definition Retipster

Rental Property Depreciation Calculator On Sale 56 Off Www Ingeniovirtual Com

Macrs Depreciation Calculator Irs Publication 946

Rental Property Profit Calculator Watch Quick Video Mortgageblog Com